Car Insurance Waco TX: Your Guide to Safe Driving

Car Insurance Waco TX is essential for any driver in the city, providing financial protection in case of accidents or unexpected events. Texas law mandates that all drivers carry a minimum amount of liability insurance, ensuring that you are financially responsible for any damages you may cause to others.

Navigating the world of car insurance can feel overwhelming, especially with the wide range of coverage options and providers available. Understanding the factors that influence your insurance rates, such as your driving history, age, and the type of vehicle you drive, is crucial for making informed decisions.

Introduction to Car Insurance in Waco, TX: Car Insurance Waco Tx

Driving a car in Waco, TX, is a necessity for many residents. However, it’s crucial to understand that owning and operating a vehicle comes with significant responsibilities, including the legal requirement of having adequate car insurance. This insurance acts as a financial safety net, protecting you and others in case of accidents or unforeseen events.

Legal Requirements for Car Insurance in Texas

Texas law mandates that all drivers carry a minimum amount of liability insurance. This coverage protects others if you are at fault in an accident. Failing to comply with these regulations can lead to serious consequences, including hefty fines, license suspension, and even jail time.

The Texas Department of Transportation (TxDOT) requires all drivers to have the following minimum liability insurance coverage:

- $30,000 bodily injury liability per person

- $60,000 bodily injury liability per accident

- $25,000 property damage liability per accident

Consequences of Driving Without Car Insurance

Driving without the required car insurance in Texas is a serious offense. Besides facing legal repercussions, you could also face significant financial hardship if you are involved in an accident.

- Fines: You could face a fine of up to $350 for the first offense, and the fines increase with subsequent offenses.

- License Suspension: Your driver’s license could be suspended until you provide proof of insurance.

- Jail Time: In some cases, driving without insurance could result in jail time, especially if you are involved in an accident.

- Financial Responsibility: If you cause an accident without insurance, you will be personally responsible for all damages and injuries, potentially leading to significant financial losses.

Factors Influencing Car Insurance Rates in Waco, TX

Several factors determine your car insurance premiums in Waco, TX. Understanding these factors can help you make informed decisions to potentially lower your costs.

Driving History

Your driving history significantly impacts your insurance rates. A clean record with no accidents or violations typically translates to lower premiums. Conversely, accidents, traffic tickets, or DUI convictions can lead to higher rates. Insurance companies assess your risk based on your past driving behavior, and a history of risky driving increases your likelihood of future claims.

Age

Age is a significant factor in car insurance rates. Younger drivers, particularly those under 25, generally have higher premiums. This is because statistically, younger drivers have less experience and are more likely to be involved in accidents. As you age and gain more experience, your rates usually decrease.

Vehicle Type

The type of vehicle you drive plays a crucial role in determining your insurance premiums. Sports cars, luxury vehicles, and high-performance cars are often associated with higher risks and therefore higher insurance rates. This is due to factors like their higher repair costs, greater potential for theft, and increased likelihood of accidents. Conversely, smaller, less expensive cars typically have lower insurance rates.

Coverage Levels

The amount of coverage you choose significantly impacts your insurance premiums. Higher coverage levels, such as comprehensive and collision coverage, provide more protection in case of an accident or damage to your vehicle. However, these additional benefits come at a higher cost. You can lower your premiums by choosing lower coverage levels, but this also means you will have less financial protection in case of an accident.

Local Factors

Local factors like traffic patterns and crime rates also influence car insurance rates. Areas with heavy traffic congestion or high crime rates tend to have higher insurance premiums. This is because these factors increase the likelihood of accidents and vehicle theft, making insurance companies more likely to pay out claims.

Types of Car Insurance Coverage in Waco, TX

Choosing the right car insurance coverage is crucial for protecting yourself financially in case of an accident or other unforeseen events. Understanding the different types of coverage available can help you make an informed decision that aligns with your specific needs and budget.

Liability Coverage

Liability coverage is a fundamental type of car insurance that protects you financially if you cause an accident that results in damage to another person’s property or injuries to another person. It is typically required by law in Texas.

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages to individuals injured in an accident that you caused.

- Property Damage Liability: This coverage pays for repairs or replacement of another person’s vehicle or property that you damaged in an accident.

For example, if you rear-end another car and cause injuries to the driver and damage to their vehicle, your liability coverage would pay for their medical bills and car repairs, up to your policy limits.

Collision Coverage

Collision coverage helps pay for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault.

- Deductible: You’ll have to pay a deductible, which is a fixed amount, before your insurance kicks in to cover the remaining costs.

- Benefits: Collision coverage is beneficial if you have a financed or leased vehicle, as it helps ensure that you can afford to repair or replace it in case of an accident.

If you hit a parked car and damage your own vehicle, collision coverage would pay for the repairs, minus your deductible.

Comprehensive Coverage

Comprehensive coverage protects you from financial losses due to damage to your vehicle caused by events other than accidents, such as theft, vandalism, fire, or natural disasters.

- Deductible: Like collision coverage, you’ll have to pay a deductible before your insurance kicks in.

- Benefits: Comprehensive coverage is essential for protecting your vehicle from unexpected events and ensuring that you can afford to repair or replace it if it’s damaged.

If your car is stolen or damaged by hail, comprehensive coverage would pay for its replacement or repairs, minus your deductible.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage protects you financially if you are injured in an accident caused by a driver who is uninsured or underinsured.

- Benefits: This coverage can help you pay for medical expenses, lost wages, and other damages that the at-fault driver’s insurance doesn’t cover.

- Types: UM coverage applies when the at-fault driver has no insurance, while UIM coverage applies when the at-fault driver has insurance but their coverage limits are insufficient to cover your damages.

If you’re hit by a driver who has no insurance and you sustain injuries, your UM coverage would help cover your medical bills and other expenses.

Choosing the Right Car Insurance Policy in Waco, TX

Finding the right car insurance policy in Waco, TX is essential for protecting yourself financially in case of an accident or other unforeseen events. It’s not just about getting the cheapest policy; it’s about getting the right coverage that meets your specific needs and circumstances. This section will guide you through the process of selecting the best car insurance policy for your situation.

Understanding Your Needs and Circumstances

Before you start comparing quotes, it’s crucial to assess your individual needs and circumstances. This will help you determine the level of coverage you require. Here are some factors to consider:

- Your Driving History: A clean driving record with no accidents or violations will generally result in lower premiums. However, if you have a history of accidents or traffic violations, you may need higher coverage to compensate for the increased risk.

- The Age and Value of Your Vehicle: Newer, more expensive vehicles typically require higher insurance premiums due to their higher repair costs. Older vehicles, on the other hand, may have lower premiums but may not offer comprehensive coverage.

- Your Location: Waco’s traffic density, crime rates, and the frequency of accidents can influence your insurance rates. Areas with higher risk factors may have higher premiums.

- Your Driving Habits: Your daily commute, the distance you drive, and the time of day you drive can impact your insurance rates. Drivers who frequently travel long distances or drive during peak traffic hours may face higher premiums.

- Your Financial Situation: Your ability to pay premiums and deductibles should be considered when choosing coverage. A higher deductible may lower your premium, but you’ll have to pay more out of pocket in case of an accident.

Getting Quotes from Multiple Insurance Providers

Once you’ve determined your needs and circumstances, it’s time to start comparing quotes from different insurance providers. Here are some tips for getting the best rates:

- Use Online Comparison Websites: Websites like Insurance.com, Policygenius, and The Zebra allow you to compare quotes from multiple insurers in one place. This can save you time and effort.

- Contact Insurance Agents Directly: Many insurance agents specialize in car insurance and can help you find the best policy for your needs. They can also answer any questions you may have about coverage and pricing.

- Ask for Discounts: Many insurance providers offer discounts for good driving records, safety features, multiple policies, and other factors. Be sure to inquire about any discounts you may qualify for.

- Review Your Policy Regularly: It’s a good idea to review your car insurance policy at least once a year to ensure it still meets your needs and that you’re not overpaying for coverage. If your circumstances have changed, such as a new car or a change in your driving habits, you may need to adjust your policy.

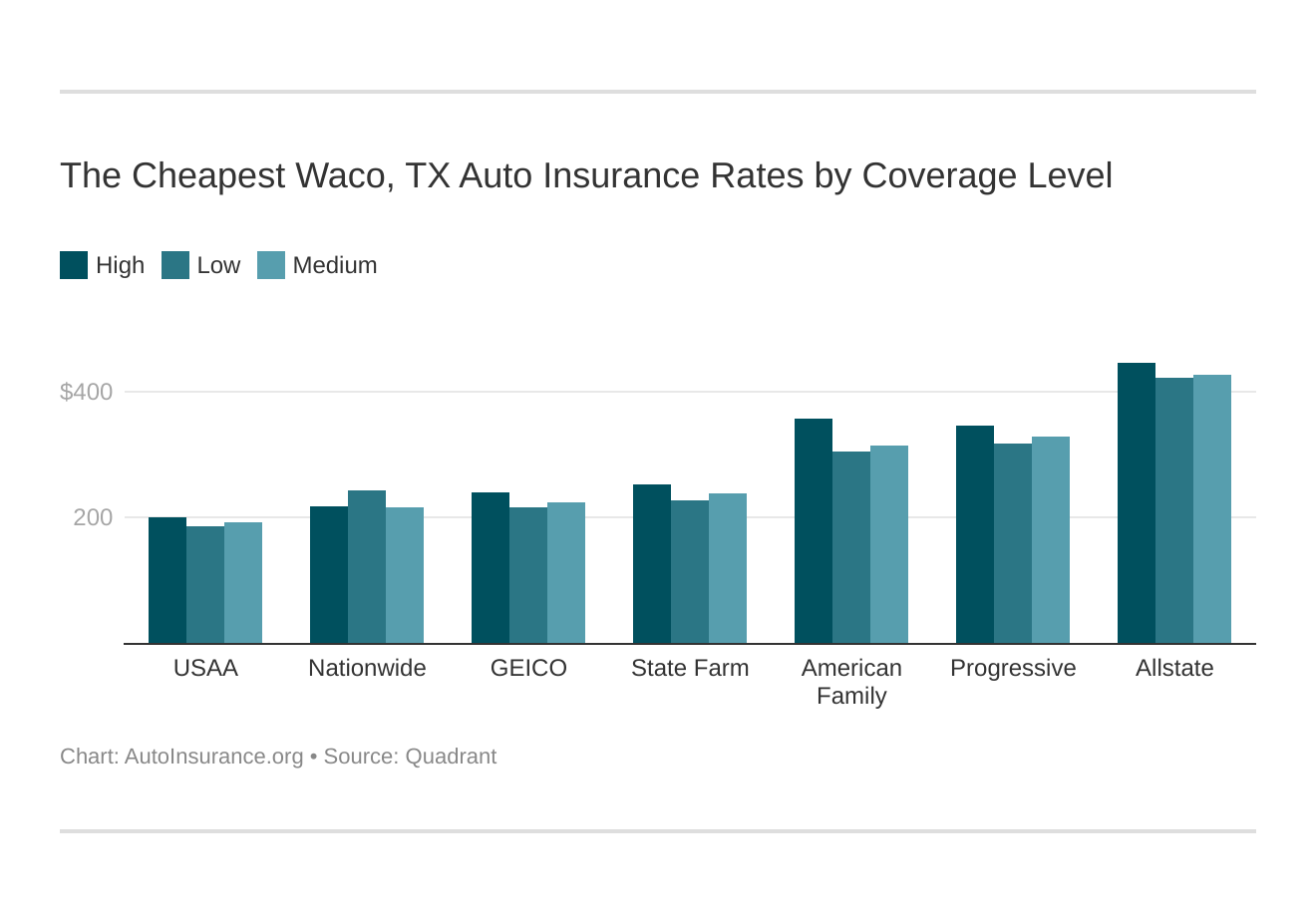

Top Car Insurance Providers in Waco, TX

Choosing the right car insurance provider can be a daunting task, especially with so many options available. This section will provide an overview of the top car insurance providers operating in Waco, TX, helping you make an informed decision based on their services, features, and customer feedback.

Top Car Insurance Providers in Waco, TX

This section will discuss the top car insurance providers in Waco, TX, based on their market presence, customer reviews, and overall reputation.

- State Farm: State Farm is one of the largest and most well-known insurance providers in the United States, offering a wide range of car insurance options. They are known for their strong financial stability, competitive rates, and excellent customer service. They are also a leading provider of auto insurance in Texas, with a significant market share.

- Geico: Geico is another major player in the car insurance industry, known for its affordable rates and convenient online and mobile services. They are particularly popular for their “15 minutes or less” quote process, which allows customers to quickly get an estimate for their insurance needs. They also offer a variety of discounts, including good driver, multi-car, and defensive driving discounts.

- Progressive: Progressive is a leading car insurance provider that is known for its innovative products and services, such as its Name Your Price tool, which allows customers to set their desired price for insurance and see what coverage options are available. They also offer a variety of discounts and have a strong reputation for customer service.

- Allstate: Allstate is a well-established insurance provider that offers a comprehensive range of car insurance products and services. They are known for their strong financial stability, competitive rates, and excellent customer service. They also offer a variety of discounts, including good driver, multi-car, and safe driving discounts.

- USAA: USAA is a highly-rated insurance provider that specializes in serving members of the military and their families. They are known for their excellent customer service, competitive rates, and a wide range of insurance products and services. USAA’s commitment to its members is reflected in its consistently high customer satisfaction ratings.

Comparing Car Insurance Providers in Waco, TX

It is essential to compare the services and features offered by different car insurance providers to find the best fit for your individual needs and budget. The following table provides a brief overview of some key factors to consider when comparing car insurance providers:

| Provider | Coverage Options | Discounts | Customer Service | Financial Stability |

|---|---|---|---|---|

| State Farm | Comprehensive, collision, liability, uninsured/underinsured motorist | Good driver, multi-car, safe driving, defensive driving | Excellent | Strong |

| Geico | Comprehensive, collision, liability, uninsured/underinsured motorist | Good driver, multi-car, defensive driving, good student | Good | Strong |

| Progressive | Comprehensive, collision, liability, uninsured/underinsured motorist | Name Your Price, good driver, multi-car, safe driving | Good | Strong |

| Allstate | Comprehensive, collision, liability, uninsured/underinsured motorist | Good driver, multi-car, safe driving, defensive driving | Good | Strong |

| USAA | Comprehensive, collision, liability, uninsured/underinsured motorist | Good driver, multi-car, safe driving, military discounts | Excellent | Strong |

Customer Reviews and Ratings for Car Insurance Providers in Waco, TX

Customer reviews and ratings can provide valuable insights into the overall experience of working with a particular car insurance provider. Several websites and organizations, such as J.D. Power, Consumer Reports, and the Better Business Bureau, provide independent reviews and ratings of car insurance providers. When evaluating customer reviews, it is important to consider the overall trend and the specific areas that are highlighted in the reviews. For example, some reviews may focus on customer service, while others may highlight the claims process or the pricing of insurance policies.

Car Insurance Discounts in Waco, TX

Saving money on your car insurance is always a good thing, and luckily, there are several discounts available in Waco, TX. These discounts can significantly reduce your premiums, so it’s worth exploring them to see what you qualify for.

Here’s a look at the common car insurance discounts available in Waco, TX:

Discounts Based on Driving Habits

Discounts based on your driving habits are a common way to save money on your car insurance. These discounts reward safe drivers and can significantly reduce your premiums.

Here are some of the most common driving-related discounts:

- Safe Driver Discount: This discount is typically offered to drivers with a clean driving record, meaning they haven’t been involved in any accidents or received any traffic violations within a specific period. The specific time frame and requirements for this discount can vary by insurance company. For example, some insurers may require a driver to be accident-free for three years, while others may require five years.

- Good Student Discount: This discount is available to students who maintain a certain grade point average (GPA). The required GPA for this discount can vary by insurance company, but it’s typically around a 3.0 or higher. For example, a student who maintains a GPA of 3.5 or higher could qualify for a 10% discount on their car insurance.

- Defensive Driving Course Discount: Completing a defensive driving course can demonstrate your commitment to safe driving practices and qualify you for a discount. The discount amount can vary depending on the insurer and the specific course you complete.

- Telematics Discount: Some insurance companies offer discounts to drivers who agree to use a telematics device, such as a plug-in device or a smartphone app, that tracks their driving habits. These devices monitor factors like speed, braking, and acceleration, and provide feedback to drivers. By demonstrating safe driving habits, you could earn a discount.

Discounts Based on Vehicle Features

Car insurance companies often offer discounts based on the safety features of your vehicle. These discounts reflect the fact that vehicles with certain safety features are less likely to be involved in accidents.

Here are some of the most common vehicle-related discounts:

- Anti-theft Device Discount: If your vehicle has anti-theft devices installed, such as an alarm system or GPS tracking, you may be eligible for a discount.

- Airbag Discount: Vehicles equipped with airbags, both front and side, can qualify for a discount.

- Anti-lock Brake Discount: Vehicles with anti-lock brakes (ABS) are less likely to be involved in accidents and may qualify for a discount.

- Daytime Running Lights Discount: Vehicles with daytime running lights, which increase visibility during the day, can also qualify for a discount.

Discounts Based on Other Factors

In addition to driving habits and vehicle features, there are other factors that can influence your car insurance rates and make you eligible for discounts.

Here are some examples:

- Multi-Policy Discount: Bundling your car insurance with other insurance policies, such as homeowners or renters insurance, can result in a significant discount.

- Payment Discount: Paying your premium in full or setting up automatic payments can qualify you for a discount.

- Loyalty Discount: Insurance companies often reward long-term customers with discounts for staying with them.

- Military Discount: Active military personnel and veterans may qualify for discounts.

- Good Credit Discount: Some insurance companies consider your credit score when determining your premiums, and those with good credit may qualify for discounts.

Filing a Car Insurance Claim in Waco, TX

Navigating the car insurance claims process can be stressful, especially after an accident. However, understanding the steps involved and the necessary documentation can make the process smoother. This guide will walk you through the process of filing a car insurance claim in Waco, TX, helping you get back on track after an accident.

Steps Involved in Filing a Car Insurance Claim

After an accident, it is essential to act promptly to ensure your claim is processed efficiently. The following steps Artikel the process of filing a car insurance claim:

- Report the Accident to Your Insurance Company: The first step is to contact your insurance company and report the accident as soon as possible. This is crucial for initiating the claims process and ensuring you receive timely assistance.

- Gather Necessary Information: Collect all relevant information about the accident, including the date, time, location, and details of the other parties involved. This information will be essential for completing your claim form.

- File the Claim Form: Your insurance company will provide you with a claim form to complete. Be sure to fill it out accurately and thoroughly, including details about the accident, your vehicle, and any injuries sustained.

- Provide Supporting Documentation: Your insurance company may request additional documentation to support your claim. This could include a police report, medical records, photographs of the damage, and repair estimates.

- Cooperate with the Insurance Company: Throughout the claims process, it is important to cooperate fully with your insurance company. This includes providing any requested information or documentation promptly and attending any scheduled appointments or inspections.

- Negotiate Settlement: Once the insurance company has reviewed your claim, they will offer a settlement. You have the right to negotiate this settlement if you believe it is inadequate. It is advisable to consult with an attorney if you have any questions or concerns about the settlement offer.

Documentation Required for a Car Insurance Claim

Providing the necessary documentation is crucial for a smooth and efficient claims process. The following documents are typically required when filing a car insurance claim:

- Police Report: If the accident involved another vehicle, a police report is essential. It provides an official record of the accident, including details of the parties involved, the location, and the circumstances of the accident.

- Driver’s License and Registration: You will need to provide your driver’s license and vehicle registration information to verify your identity and the details of your vehicle.

- Proof of Insurance: Your insurance company will require proof of insurance to verify that you have the necessary coverage.

- Medical Records: If you sustained injuries in the accident, you will need to provide medical records to document the extent of your injuries and the associated medical expenses.

- Repair Estimates: If your vehicle was damaged, you will need to obtain repair estimates from a reputable auto body shop. These estimates should provide a detailed breakdown of the repairs needed and the associated costs.

- Photographs of the Damage: Photographs of the damage to your vehicle and the accident scene can provide valuable evidence to support your claim.

Tips for Ensuring a Smooth and Efficient Claims Process

To ensure a smooth and efficient claims process, consider the following tips:

- Act Promptly: Contact your insurance company as soon as possible after the accident to report the incident and initiate the claims process.

- Be Thorough and Accurate: Complete the claim form accurately and thoroughly, providing all necessary information and documentation.

- Communicate Effectively: Keep in touch with your insurance company and respond promptly to any requests for information or documentation.

- Keep Records: Maintain a file of all documents related to the accident, including the police report, medical records, repair estimates, and communication with your insurance company.

- Consider Legal Counsel: If you have any questions or concerns about the claims process or the settlement offer, it is advisable to consult with an attorney.

Car Insurance Resources in Waco, TX

Navigating the world of car insurance can feel overwhelming, especially when you’re trying to find the best coverage for your needs. Fortunately, Waco, TX, offers a range of resources to help you understand your options and make informed decisions.

Local Insurance Agencies

Local insurance agencies provide personalized guidance and support. They can answer your questions, compare different policies, and help you find the best coverage for your specific situation.

- State Farm: (254) 772-2400

- Allstate: (254) 753-5500

- Farmers Insurance: (254) 772-2444

- Geico: (254) 772-1111

- Progressive: (254) 753-1212

Online Resources

The internet provides a wealth of information on car insurance. You can use online comparison tools to quickly get quotes from multiple insurers, read reviews, and learn about different coverage options.

- Texas Department of Insurance: https://www.tdi.texas.gov/ (Provides information on Texas insurance laws, consumer protection, and resources for filing complaints.)

- Insurance Information Institute: https://www.iii.org/ (Offers educational resources on various insurance topics, including car insurance.)

- NerdWallet: https://www.nerdwallet.com/ (Provides car insurance comparison tools, articles, and advice.)

Government Websites

Government websites offer valuable information on car insurance requirements, regulations, and consumer rights.

- Texas Department of Motor Vehicles: https://www.txdmv.gov/ (Provides information on vehicle registration, driver’s licenses, and other related topics.)

- National Highway Traffic Safety Administration: https://www.nhtsa.gov/ (Offers safety information, vehicle recalls, and resources for consumers.)

Safety Tips for Drivers in Waco, TX

Waco, like any city, has its own unique driving challenges. Navigating busy streets, dealing with unpredictable weather, and encountering diverse road conditions require drivers to be vigilant and prepared. This section provides practical safety tips to help drivers in Waco stay safe and avoid accidents.

Defensive Driving Techniques

Defensive driving is a proactive approach to driving that emphasizes anticipating potential hazards and taking steps to avoid them. It’s about being aware of your surroundings and making safe decisions behind the wheel.

- Maintain a Safe Following Distance: One of the most important defensive driving techniques is maintaining a safe following distance. This gives you time to react if the car in front of you suddenly brakes or changes lanes. A good rule of thumb is to keep at least three seconds between your car and the vehicle in front of you.

- Scan the Road Ahead: Always be scanning the road ahead, looking for potential hazards such as stopped vehicles, pedestrians, cyclists, or animals. This allows you to anticipate potential problems and react accordingly.

- Be Aware of Your Surroundings: Pay attention to your surroundings, including other vehicles, pedestrians, cyclists, and road signs. Be aware of blind spots and use your mirrors and turn signals frequently.

- Avoid Distracted Driving: Distracted driving is a major cause of accidents. Avoid using your cell phone, eating, or applying makeup while driving. Keep your eyes on the road and your hands on the wheel.

Avoiding Common Accidents

Waco, like any city, has its own set of common driving hazards. Understanding these hazards can help drivers avoid accidents.

- Intersection Accidents: Intersections are a common site for accidents. Always come to a complete stop at red lights and stop signs, and be aware of other vehicles and pedestrians before proceeding.

- Rear-End Collisions: Rear-end collisions are another common type of accident. Maintaining a safe following distance can help prevent these accidents.

- Parking Lot Accidents: Parking lots can be congested and confusing, making them a common spot for accidents. Drive slowly and be aware of pedestrians and other vehicles.

Regular Vehicle Maintenance and Safety Checks, Car insurance waco tx

Regular vehicle maintenance is crucial for ensuring your car is in good working order and safe to drive.

- Check Tire Pressure: Underinflated tires can lead to blowouts and affect your car’s handling. Check your tire pressure regularly and inflate them to the recommended pressure level.

- Inspect Your Brakes: Your brakes are essential for stopping safely. Have them inspected regularly by a qualified mechanic and replace worn brake pads or rotors.

- Change Your Oil: Regular oil changes are important for maintaining your engine’s health. Follow the recommended oil change intervals for your car.

- Check Your Lights: Make sure all your headlights, taillights, and turn signals are working properly.

Driving in Inclement Weather

Driving in inclement weather can be dangerous. It’s important to take extra precautions when driving in rain, snow, or ice.

- Reduce Speed: Reduce your speed in wet or icy conditions to give yourself more time to react.

- Increase Following Distance: Increase your following distance to allow for longer braking distances.

- Avoid Sudden Movements: Avoid sudden braking or acceleration, which can cause your car to skid.

- Use Headlights: Use your headlights, even during the day, to improve visibility.

Conclusion

By understanding the intricacies of car insurance in Waco, TX, you can make informed decisions about your coverage and ensure that you are adequately protected on the road.

Finding the right car insurance in Waco, TX can be a bit of a challenge, especially if you’re new to the area. It’s helpful to compare quotes from different insurance companies to find the best coverage at a reasonable price.

You might even want to check out what’s available for car insurance quotes in Louisiana to get a broader perspective on rates and options. Ultimately, the best car insurance for you in Waco will depend on your individual needs and driving history.

Post a Comment