Car Insurance Rate Quotes: Finding the Best Deal

Car insurance rate quotes are the starting point for finding the right coverage at the best price. Understanding the factors that influence these quotes is crucial for making informed decisions about your insurance needs. From driving history and vehicle type to location and credit score, numerous factors can affect your premiums.

This guide will provide you with a comprehensive understanding of car insurance rate quotes, helping you navigate the complexities of the insurance market. We’ll explore the key factors that influence your rates, guide you through the process of obtaining quotes, and offer strategies for saving money on your insurance premiums.

Understanding Car Insurance Rate Quotes

Getting a car insurance quote can feel like deciphering a secret code. Many factors influence your rates, and understanding them is crucial for finding the best coverage at a price you can afford. This guide will help you navigate the world of car insurance quotes, providing clarity on how your rates are calculated and what you can do to save money.

Factors Influencing Car Insurance Rates

Several factors contribute to your car insurance premium. Understanding these factors allows you to make informed decisions that could potentially lower your costs.

- Your Driving Record: A clean driving record with no accidents or traffic violations is a significant factor in obtaining lower rates. Insurers consider your history of safe driving as a positive indicator.

- Your Age and Gender: Statistics show that younger and inexperienced drivers are statistically more likely to be involved in accidents. Therefore, insurers may charge higher premiums for this demographic. Similarly, gender can also play a role in pricing, as certain genders have historically shown different driving patterns.

- Your Location: Your location, specifically the city or state you live in, plays a role in determining your rates. Areas with higher crime rates or traffic congestion may have higher insurance premiums due to a higher risk of accidents.

- Your Vehicle: The type of vehicle you drive is a significant factor. Luxury cars, high-performance vehicles, and vehicles with safety features are often associated with higher insurance costs. Factors like the vehicle’s age, make, and model also play a role.

- Your Coverage: The type and amount of coverage you choose directly affect your premium. Higher coverage limits and comprehensive coverage typically result in higher premiums. However, adequate coverage is crucial for financial protection in case of an accident.

- Your Credit Score: In some states, insurers can use your credit score to determine your insurance rates. A higher credit score generally indicates a lower risk to the insurer and can lead to lower premiums.

Types of Car Insurance Coverage

Understanding the different types of car insurance coverage is essential for making informed decisions about your policy.

- Liability Coverage: This coverage protects you financially if you cause an accident that injures another person or damages their property. It covers the other party’s medical expenses, lost wages, and property damage.

- Collision Coverage: This coverage pays for repairs to your vehicle if you are involved in an accident, regardless of who is at fault. It covers damage caused by collisions with another vehicle or an object.

- Comprehensive Coverage: This coverage protects your vehicle against damages from non-collision events such as theft, vandalism, fire, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who does not have insurance or does not have enough insurance to cover your damages. It can help cover your medical expenses and property damage.

- Personal Injury Protection (PIP): This coverage, also known as no-fault insurance, covers your medical expenses and lost wages if you are injured in an accident, regardless of who is at fault.

- Medical Payments Coverage (Med Pay): This coverage pays for your medical expenses, regardless of who is at fault, up to a certain limit. It is often included as part of a liability policy.

Comparing Quotes from Multiple Insurers

Once you understand the factors influencing your rates and the different types of coverage available, the next step is to compare quotes from multiple insurers. This process is essential for finding the best coverage at the most competitive price.

- Use Online Comparison Tools: Several websites allow you to enter your information and receive quotes from multiple insurers simultaneously. This saves you time and effort compared to contacting each insurer individually.

- Contact Insurers Directly: While online comparison tools are helpful, contacting insurers directly can provide more personalized quotes and allow you to ask specific questions.

- Consider Your Needs: When comparing quotes, consider your individual needs and risk tolerance. A lower premium may not be the best option if it means sacrificing essential coverage.

Key Factors Affecting Car Insurance Rates

Your car insurance premium is calculated based on a variety of factors, and understanding these factors can help you make informed decisions to potentially lower your rates. Here are some of the most significant elements that insurance companies consider when determining your car insurance costs.

Driving History

Your driving history plays a crucial role in determining your car insurance rates. Insurance companies consider your driving record, including accidents, traffic violations, and driving convictions, to assess your risk profile.

- Accidents: Accidents, especially those involving injuries or significant property damage, significantly increase your insurance premiums. Insurance companies view accidents as a strong indicator of future risk.

- Traffic Violations: Traffic violations, such as speeding tickets, running red lights, or reckless driving, also contribute to higher insurance rates. These violations demonstrate a disregard for traffic laws and increase the likelihood of future accidents.

- Driving Convictions: Driving convictions, such as DUI/DWI or driving without a license, carry the most significant impact on insurance rates. These convictions indicate a serious disregard for safety and can result in substantial premium increases or even policy cancellation.

Vehicle Type and Age

The type and age of your vehicle are significant factors that affect your car insurance rates. Insurance companies assess the risk associated with different vehicles based on factors like safety features, repair costs, and theft susceptibility.

- Vehicle Type: Sports cars, luxury vehicles, and high-performance vehicles are generally considered riskier to insure due to their higher speeds, powerful engines, and potential for expensive repairs. On the other hand, smaller, less powerful vehicles are typically associated with lower insurance rates.

- Vehicle Age: Newer vehicles are often equipped with advanced safety features and are generally more expensive to repair, leading to higher insurance premiums. Older vehicles, while often less expensive to repair, may lack modern safety features and be more prone to breakdowns, potentially increasing your insurance costs.

Location and Zip Code

Your location and zip code play a significant role in determining your car insurance rates. Insurance companies consider factors like the density of traffic, crime rates, and the frequency of accidents in your area to assess the risk of insuring you.

- Traffic Density: Areas with heavy traffic are more likely to experience accidents, increasing the risk of claims and potentially leading to higher insurance premiums.

- Crime Rates: High crime rates, particularly those involving vehicle theft, can also influence your insurance rates. Insurance companies may consider areas with high crime rates as riskier, resulting in higher premiums.

- Frequency of Accidents: Areas with a high frequency of accidents, regardless of the cause, are generally associated with higher insurance rates. Insurance companies assess the overall risk of insuring drivers in these areas, which can lead to increased premiums.

Credit Score

Your credit score may seem unrelated to car insurance, but insurance companies often use it as a proxy for financial responsibility. A higher credit score generally indicates responsible financial behavior, which can translate into lower insurance premiums.

- Credit Score as a Risk Indicator: Insurance companies often view individuals with poor credit scores as higher risks. This is because they may be more likely to file claims and less likely to pay their premiums on time.

- Credit Score and Insurance Rates: While credit score is not the sole factor, a lower credit score can lead to higher insurance premiums, as insurance companies may perceive you as a greater financial risk.

Getting Car Insurance Quotes

Once you understand the basics of car insurance, you’re ready to start getting quotes. This process can seem daunting, but it’s actually quite simple. By following a few steps and using the right resources, you can easily compare quotes from different insurers and find the best policy for your needs.

Obtaining Car Insurance Quotes Online

The internet offers a convenient and efficient way to obtain car insurance quotes. Several websites allow you to compare quotes from multiple insurers simultaneously.

- Visit Comparison Websites: Websites like Policygenius, The Zebra, and Insurance.com let you enter your information once and receive quotes from several insurers. This saves you time and effort compared to visiting each insurer’s website individually.

- Go Directly to Insurer Websites: If you prefer to work directly with a specific insurer, visit their website and use their online quote tool. Many insurers have user-friendly websites that guide you through the quoting process step-by-step.

- Provide Accurate Information: When filling out quote forms, be sure to provide accurate information about your vehicle, driving history, and desired coverage. This ensures you receive the most accurate quotes and avoid any surprises later.

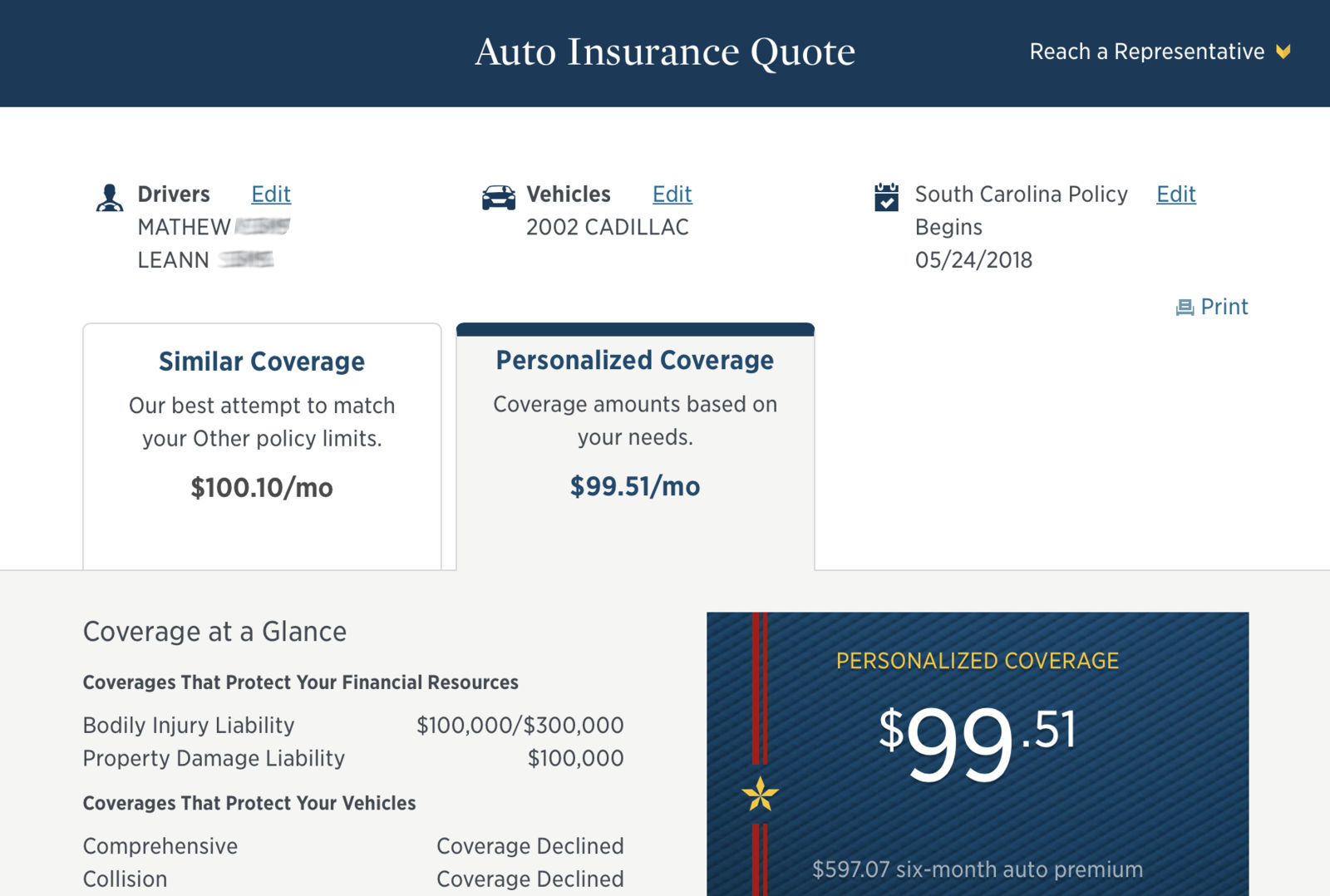

- Compare Quotes Carefully: Once you receive quotes from different insurers, compare them carefully. Pay attention to the coverage amounts, deductibles, and premiums. You may also want to consider the insurer’s financial stability, customer service ratings, and ease of claims processing.

- Contact Insurers for Clarification: If you have any questions about the quotes you receive, don’t hesitate to contact the insurers directly. They can clarify any details and help you understand the terms of their policies.

Finding Reputable Insurance Companies

While getting quotes online is convenient, it’s essential to ensure you’re dealing with reputable insurance companies.

- Check Financial Stability: Look for insurers with strong financial ratings from agencies like AM Best or Standard & Poor’s. This indicates the company is financially sound and likely to be able to pay claims.

- Read Customer Reviews: Check online review websites like Yelp, Trustpilot, and Consumer Reports to see what other customers have to say about an insurer’s service and claims handling.

- Consider Recommendations: Ask friends, family, and colleagues for recommendations on insurers they’ve had positive experiences with.

- Contact Your State Insurance Department: If you have concerns about an insurer’s practices, you can contact your state insurance department for information and assistance.

Comparing Insurance Providers

Here’s a table comparing the features and benefits of different insurance providers:

| Provider | Coverage Options | Discounts | Customer Service | Financial Rating |

|---|---|---|---|---|

| Progressive | Comprehensive, collision, liability, uninsured/underinsured motorist | Safe driver, good student, multi-car, multi-policy | Excellent customer service ratings | A+ (Superior) from AM Best |

| Geico | Comprehensive, collision, liability, uninsured/underinsured motorist | Safe driver, good student, multi-car, multi-policy | Above average customer service ratings | A+ (Superior) from AM Best |

| State Farm | Comprehensive, collision, liability, uninsured/underinsured motorist | Safe driver, good student, multi-car, multi-policy | Above average customer service ratings | A+ (Superior) from AM Best |

| Allstate | Comprehensive, collision, liability, uninsured/underinsured motorist | Safe driver, good student, multi-car, multi-policy | Above average customer service ratings | A+ (Superior) from AM Best |

| USAA | Comprehensive, collision, liability, uninsured/underinsured motorist | Safe driver, good student, multi-car, multi-policy | Excellent customer service ratings | A+ (Superior) from AM Best |

Understanding Insurance Policies

It’s crucial to understand the terms and conditions Artikeld in your car insurance policy. This ensures you’re aware of the coverage you have and what to expect in case of an accident or other insured event.

Key Terms and Conditions

Car insurance policies contain various terms and conditions that define the coverage and obligations of both the insurer and the policyholder.

- Coverage: This refers to the specific types of protection provided by the policy, such as liability, collision, comprehensive, and personal injury protection (PIP).

- Deductible: This is the amount you pay out of pocket for covered repairs or losses before your insurance kicks in. A higher deductible usually means lower premiums, while a lower deductible leads to higher premiums.

- Premium: This is the regular payment you make to maintain your insurance coverage. Premiums are calculated based on various factors, including your driving record, vehicle type, location, and coverage levels.

- Limits: These are the maximum amounts your insurer will pay for covered losses, such as medical expenses, property damage, or lost wages. Limits can vary depending on the type of coverage and your policy.

- Exclusions: These are specific events or situations that are not covered by your insurance policy. For example, most policies exclude coverage for intentional acts, driving under the influence, or racing.

- Policy Period: This is the duration for which your insurance coverage is active, usually a year.

- Renewal: After the policy period ends, you can choose to renew your insurance policy, potentially with adjustments to coverage or premiums based on factors like driving record or vehicle changes.

Deductibles and Coverage Limits

Deductibles and coverage limits are crucial aspects of car insurance policies that influence the financial responsibility you bear in case of an accident.

- Deductible: This is the amount you pay out of pocket before your insurance coverage kicks in. For example, if you have a $500 deductible and your car sustains $2,000 worth of damage in an accident, you would pay $500 and your insurance would cover the remaining $1,500.

- Collision Deductible: This applies to damages caused by collisions with other vehicles or objects.

- Comprehensive Deductible: This covers damages caused by non-collision events like theft, vandalism, or natural disasters.

- Coverage Limits: These represent the maximum amounts your insurer will pay for covered losses.

- Liability Limits: These define the maximum amount your insurer will pay for bodily injury or property damage caused to others in an accident.

- Medical Payments Limits: This covers medical expenses for you and your passengers, regardless of fault, up to a specific limit.

- Uninsured/Underinsured Motorist Coverage Limits: These protect you if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage.

Reviewing and Understanding Insurance Policy Documents

Thoroughly reviewing and understanding your car insurance policy documents is essential.

- Read the entire policy carefully: Pay attention to all the terms and conditions, especially the fine print, to avoid any surprises later.

- Ask questions: If you don’t understand anything, contact your insurance agent or company for clarification. It’s better to be safe than sorry.

- Keep your policy documents readily available: This ensures you can refer to them when needed, such as in case of an accident or claim.

Saving Money on Car Insurance

Car insurance is a necessity for most drivers, but it can be a significant expense. Fortunately, there are several ways to reduce your car insurance premiums and save money. By understanding these strategies, you can find the best coverage at a price that fits your budget.

Ways to Reduce Car Insurance Premiums

There are several ways to lower your car insurance premiums. These include:

- Maintain a Good Driving Record: A clean driving record is essential for getting lower rates. Avoid traffic violations, accidents, and other driving infractions. Your driving record is a major factor in determining your insurance premiums.

- Choose a Safe Vehicle: Certain car models are considered safer than others, and insurance companies often offer lower premiums for these vehicles. Research car safety ratings and choose a vehicle with good safety features.

- Increase Your Deductible: A deductible is the amount you pay out of pocket before your insurance coverage kicks in. Increasing your deductible can significantly reduce your premiums. However, make sure you can afford to pay the higher deductible if you need to file a claim.

- Shop Around for Quotes: Don’t settle for the first quote you receive. Compare rates from multiple insurance companies to find the best deal. Use online comparison tools or contact insurance agents directly.

- Consider Discounts: Many insurance companies offer discounts for various factors, such as good student discounts, safe driver discounts, multi-car discounts, and loyalty discounts. Ask your insurance company about available discounts and see if you qualify.

- Take a Defensive Driving Course: Completing a defensive driving course can demonstrate your commitment to safe driving and earn you a discount on your premiums. These courses often teach you about safe driving techniques and traffic laws.

- Install Anti-theft Devices: Installing anti-theft devices, such as alarms or tracking systems, can deter theft and reduce your insurance premiums. These devices make your car less attractive to thieves, leading to lower risk for insurance companies.

Negotiating with Insurance Companies

Negotiating with insurance companies can be a challenging process, but it’s worth trying to get the best possible rate. Here are some strategies for negotiating:

- Be Prepared: Before contacting your insurance company, gather all relevant information, such as your driving record, vehicle information, and details of any discounts you qualify for. Be prepared to discuss your specific needs and expectations.

- Be Polite and Persistent: Maintain a professional and courteous demeanor throughout the negotiation process. Be persistent in seeking a lower rate, but avoid being aggressive or demanding.

- Highlight Your Positive Factors: Emphasize your good driving record, safe vehicle, and any other factors that make you a low-risk driver. This can help convince the insurance company to offer you a lower rate.

- Be Willing to Compromise: You may not always get the exact rate you want, so be prepared to compromise. Consider increasing your deductible or making other adjustments to your policy to achieve a lower premium.

- Consider Switching Companies: If you can’t negotiate a satisfactory rate with your current insurance company, consider switching to another company. Shop around for quotes and compare rates before making a decision.

Benefits of Bundling Insurance Policies

Bundling your car insurance with other types of insurance, such as homeowners or renters insurance, can often lead to significant savings. Here’s why:

- Discounts: Insurance companies typically offer discounts for bundling multiple policies. These discounts can vary depending on the insurer and the types of policies bundled.

- Convenience: Bundling policies can simplify your insurance needs and make it easier to manage your coverage. You’ll have a single point of contact for all your insurance needs.

- Improved Customer Service: Bundling your policies can sometimes lead to better customer service, as insurance companies may prioritize customers with multiple policies.

Factors to Consider When Choosing an Insurance Provider

Choosing the right car insurance provider is crucial, as it can significantly impact your financial well-being in case of an accident or other covered events. While getting competitive quotes is essential, it’s equally important to evaluate the insurer’s overall capabilities and reputation before making a decision.

Financial Stability and Customer Service

It’s vital to ensure your insurer is financially sound to ensure they can pay out claims when needed. Research the insurer’s financial stability by checking their credit ratings, such as those provided by agencies like A.M. Best or Standard & Poor’s. These ratings assess the insurer’s ability to meet its financial obligations. Additionally, explore customer service ratings from independent organizations like J.D. Power or Consumer Reports. These ratings provide insights into the insurer’s responsiveness, fairness, and overall customer satisfaction.

Car Insurance After an Accident

Accidents are unfortunate events that can disrupt your life and have a significant impact on your car insurance. Knowing how to navigate the insurance process after an accident is crucial to ensure a smooth recovery and protect your financial well-being.

Filing a Claim After an Accident

After an accident, it’s essential to take immediate steps to protect yourself and your vehicle. Start by ensuring everyone involved is safe, then call the police to report the accident. Take pictures of the damage to all vehicles and the accident scene, and gather contact information from all parties involved. Once you have gathered the necessary information, you can file a claim with your insurance company.

- Contact your insurance company immediately: Report the accident to your insurer as soon as possible. Most insurance companies have 24/7 claims reporting lines.

- Provide accurate information: Be honest and thorough when providing information about the accident. This includes details about the location, date, time, and any contributing factors.

- Follow your insurer’s instructions: Your insurance company will provide specific instructions for filing a claim. Be sure to follow these instructions carefully.

Dealing with Insurance Adjusters, Car insurance rate quotes

An insurance adjuster is a representative of your insurance company who will investigate the accident and determine the extent of the damage. They will also be responsible for assessing the cost of repairs or replacement.

- Be polite and cooperative: While you may be frustrated after an accident, it’s important to remain calm and polite when dealing with the adjuster.

- Provide all necessary documentation: The adjuster will need to see proof of ownership of your vehicle, the police report, and any other relevant documentation.

- Be aware of your rights: You have the right to have an attorney present during any negotiations with the adjuster. If you are unsure about anything, don’t hesitate to ask questions.

Impact of an Accident on Future Insurance Rates

An accident can significantly impact your future car insurance rates. Insurance companies view accidents as a risk factor, and they may increase your premiums as a result. The extent of the increase will depend on several factors, including:

- Severity of the accident: A more severe accident, such as one involving injuries or significant property damage, will generally result in a larger rate increase.

- Who was at fault: If you were at fault for the accident, your insurance rates will likely increase more than if you were not at fault.

- Your driving history: Your driving history, including any previous accidents or violations, will also play a role in determining the rate increase.

Tip: Consider taking a defensive driving course to improve your driving skills and potentially reduce your insurance rates.

Understanding Your Coverage

It is important to understand the details of your car insurance policy, including the specific coverage you have and the limits of your policy. This information will help you navigate the claims process and ensure you receive the appropriate compensation.

- Review your policy: Carefully read your policy to understand the coverage you have, including the deductibles and limits.

- Contact your insurance company: If you have any questions about your policy, don’t hesitate to contact your insurance company for clarification.

- Consider increasing your coverage: After an accident, you may want to consider increasing your coverage limits to ensure you are adequately protected in the event of a future accident.

Common Car Insurance Myths

Car insurance is a vital financial safety net, protecting you and your loved ones in the event of an accident. However, many misconceptions surround car insurance, which can lead to poor decision-making and inadequate coverage. Let’s debunk some common car insurance myths and ensure you have the accurate information to make informed choices about your coverage.

Myth: You Don’t Need Car Insurance If You’re a Good Driver

This is a dangerous misconception. Even the safest drivers can be involved in accidents, and not having car insurance can lead to significant financial hardship. Accidents can happen due to unforeseen circumstances, such as driver error, road conditions, or other drivers’ negligence. Without car insurance, you could be responsible for covering the costs of repairs, medical expenses, and legal fees, potentially leading to substantial debt.

Myth: Cheaper Car Insurance Means Better Coverage

The price of car insurance is not always a reliable indicator of coverage. While it’s tempting to choose the cheapest option, it’s essential to compare coverage options and ensure you have adequate protection for your specific needs. A lower premium may mean limited coverage or higher deductibles, leaving you with more out-of-pocket expenses in the event of an accident.

Myth: Your Car Insurance Will Cover Everything

Car insurance policies have limitations and exclusions. It’s crucial to carefully read your policy to understand what’s covered and what’s not. Some common exclusions include:

- Damage caused by wear and tear or routine maintenance

- Damage caused by acts of God, such as earthquakes or floods (unless you have specific coverage)

- Damage resulting from driving under the influence of alcohol or drugs

- Damage caused by intentional acts, such as vandalism or theft

Myth: Filing a Small Claim Will Raise Your Premiums

Filing a claim, even for a minor accident, can impact your insurance premiums. However, the impact is not always significant, and it’s often better to file a claim than to risk being responsible for substantial costs. Insurance companies use a complex system to calculate premiums based on various factors, including claims history. A single minor claim may not result in a drastic increase, especially if your overall driving record is good.

Myth: You Can’t Get Car Insurance If You Have a Bad Driving Record

While a poor driving record can make obtaining car insurance more challenging, it doesn’t mean it’s impossible. There are specialized insurance providers who cater to drivers with less-than-perfect records. These companies may offer higher premiums but provide the necessary coverage. It’s essential to shop around and compare quotes from different providers to find the best option for your situation.

Myth: Car Insurance Fraud is a Victimless Crime

Car insurance fraud is a serious crime with significant consequences for everyone. It increases insurance premiums for all policyholders, as insurance companies have to pass on the cost of fraudulent claims. If you suspect someone is committing car insurance fraud, report it to the authorities immediately.

Myth: You Don’t Need Collision Coverage If You Have a Low-Value Car

Collision coverage protects you from financial loss if your car is damaged in an accident, regardless of who is at fault. Even if you have an older car with a low value, collision coverage can help you cover the cost of repairs or replacement, especially if you’re involved in a serious accident.

Myth: You Can’t Get Car Insurance Without a Credit Check

While some insurance companies may use credit history as a factor in determining premiums, it’s not a requirement for obtaining car insurance. Many insurers offer policies without a credit check, especially if you have a good driving record and a clean claims history.

Car Insurance for Different Situations

Car insurance is a necessity for all drivers, but the specific needs of each driver can vary greatly. This section will explore car insurance options for different situations, such as new drivers, high-risk drivers, and individuals with unique driving requirements.

Car Insurance for New Drivers

New drivers often face higher insurance premiums due to their lack of experience and driving history. To help mitigate this, consider the following:

- Take a defensive driving course: These courses can demonstrate safe driving practices and may earn you a discount on your insurance premium.

- Maintain a good driving record: Avoid traffic violations and accidents, as these can significantly impact your insurance rates.

- Consider a “good student” discount: Many insurers offer discounts to students with good grades.

- Explore “pay-per-mile” insurance: This option can be beneficial for new drivers who drive less frequently.

- Compare quotes from multiple insurers: Shopping around for the best rates can help you save money.

Car Insurance for High-Risk Drivers

Drivers with a history of accidents, traffic violations, or DUI convictions are considered high-risk and may face higher premiums. Here are some tips:

- Consider a specialized insurer: Some insurers specialize in insuring high-risk drivers and may offer more competitive rates.

- Improve your driving record: By avoiding further violations or accidents, you can gradually lower your risk profile and potentially reduce your premiums over time.

- Explore options for driver training: Some insurers offer discounts for completing defensive driving courses or other driver training programs.

- Increase your deductible: A higher deductible can lead to lower premiums, but you’ll have to pay more out of pocket if you need to file a claim.

Car Insurance for Unique Driving Requirements

Individuals with specific driving needs, such as those who drive for work or have specialized vehicles, may require additional coverage.

- Commercial auto insurance: For individuals who use their vehicles for business purposes, commercial auto insurance provides specialized coverage.

- Classic car insurance: Classic cars may require unique coverage to protect their value and specialized needs.

- Ridesharing insurance: If you use your vehicle for ridesharing services, you’ll need additional coverage to protect yourself and your passengers.

Car Insurance in a Changing World: Car Insurance Rate Quotes

The car insurance industry is undergoing a significant transformation, driven by advancements in technology and evolving consumer expectations. The rise of connected cars, data analytics, and artificial intelligence is reshaping how car insurance is priced, purchased, and delivered.

The Impact of Technology on Car Insurance

Technology is fundamentally altering the landscape of car insurance. Connected cars, equipped with sensors and telematics devices, generate vast amounts of data about driving behavior, vehicle performance, and environmental conditions. This data provides insurers with unprecedented insights into individual driving habits, allowing for more accurate risk assessments and personalized pricing.

The Rise of Telematics and Usage-Based Insurance

Telematics, the use of technology to monitor and analyze driving behavior, is playing a pivotal role in the evolution of car insurance. Usage-based insurance (UBI) programs leverage telematics data to tailor premiums based on actual driving patterns. Drivers with safe driving habits, such as avoiding speeding or hard braking, can often qualify for lower premiums.

“UBI programs are based on the principle that drivers who exhibit safe driving behaviors should be rewarded with lower premiums, while those who engage in riskier driving practices should pay more.”

Potential for Future Changes in Car Insurance Practices

The future of car insurance holds exciting possibilities. The advent of autonomous vehicles is expected to have a profound impact on the industry. With self-driving cars taking over the task of driving, the traditional factors that influence car insurance rates, such as driver experience and driving history, may become less relevant.

“As autonomous vehicles become more prevalent, the focus of car insurance may shift from individual drivers to the technology and manufacturers responsible for the vehicles themselves.”

Additional Resources and Information

You’ve navigated through the intricacies of car insurance rates, but the journey doesn’t end here. This section provides valuable resources and information to empower you to make informed decisions about your car insurance.

Car Insurance Comparison Websites

These websites allow you to compare quotes from multiple insurance providers in one place, saving you time and effort. They often offer additional features like reviews, ratings, and customer testimonials, making your decision-making process more informed.

- Compare.com: A popular platform known for its user-friendly interface and comprehensive quote comparisons.

- Policygenius: A well-regarded site that focuses on personalized insurance recommendations based on your specific needs.

- The Zebra: This platform is known for its wide range of insurance options, including specialty coverage for unique vehicles.

State Insurance Departments

Each state has a dedicated insurance department that serves as a resource for consumers. These departments can help resolve complaints, provide information about insurance regulations, and offer guidance on finding the right insurance provider.

- National Association of Insurance Commissioners (NAIC): The NAIC website provides a directory of state insurance departments, making it easy to find contact information for your specific state.

- State-Specific Websites: Most state insurance departments have their own websites with detailed information about insurance regulations, consumer rights, and resources.

Seeking Professional Advice

For complex insurance needs or situations, consulting with a professional insurance agent or broker can be beneficial. They can offer personalized advice, explain your options, and help you navigate the complexities of insurance policies.

- Independent Insurance Agents: These agents work with multiple insurance companies, allowing them to provide a wider range of options.

- Insurance Brokers: Brokers act as your advocate, helping you find the best insurance policies and negotiate rates.

- Financial Advisors: If your insurance needs are intertwined with your overall financial planning, a financial advisor can provide comprehensive guidance.

Final Wrap-Up

Finding the best car insurance rate quote requires a proactive approach. By understanding the factors that influence your rates, comparing quotes from multiple insurers, and carefully reviewing your policy documents, you can ensure you have the coverage you need at a price that fits your budget. Remember, car insurance is a vital component of responsible driving, and taking the time to make informed decisions can save you money and peace of mind in the long run.

Getting car insurance rate quotes can be a bit overwhelming, with so many factors influencing the price. To get a good idea of what you might pay, it’s a good idea to compare quotes from different insurance companies. One popular option is to check out a car insurance Geico quote to see how their rates compare to others.

Once you have a few quotes, you can analyze the coverage options and choose the policy that best suits your needs and budget.

Post a Comment