Car Insurance Prices NYC: Navigating the Costs

Car insurance prices NYC can be a daunting prospect, especially considering the city’s unique driving environment and high population density. Navigating the complexities of car insurance in New York City requires a comprehensive understanding of factors that influence premiums, available coverage options, and strategies for finding the best deals.

This guide delves into the intricacies of car insurance in NYC, providing insights into the factors that impact costs, tips for finding affordable coverage, and essential information for new drivers and seasoned motorists alike. Whether you’re a seasoned driver or a newcomer to the city, understanding the nuances of car insurance in NYC is crucial for making informed decisions and ensuring financial protection on the road.

Understanding Car Insurance in NYC

Navigating the world of car insurance in New York City can feel overwhelming, with its unique factors and complex regulations. This guide will help you understand the intricacies of car insurance in NYC, enabling you to make informed decisions and secure the right coverage for your needs.

Factors Influencing Car Insurance Prices in NYC

Car insurance prices in NYC are influenced by a combination of factors, including:

- High Traffic Density: NYC’s dense traffic and congested roads increase the risk of accidents, leading to higher insurance premiums.

- High Cost of Living: The high cost of living in NYC, including medical expenses and vehicle repair costs, contributes to higher insurance premiums.

- High Crime Rates: NYC’s crime rate, including car theft and vandalism, also impacts insurance prices.

- Driving Habits: Factors like your driving record, age, and driving history play a significant role in determining your insurance premiums.

- Vehicle Type: The type of vehicle you own, its value, and safety features also influence your insurance rates.

Types of Car Insurance Coverage in NYC

Here’s a breakdown of the different types of car insurance coverage commonly available in NYC:

- Liability Coverage: This coverage protects you financially if you cause an accident that injures someone or damages their property. It is mandatory in NYC and covers bodily injury liability and property damage liability.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of fault. It is optional but highly recommended.

- Comprehensive Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged due to events like theft, vandalism, fire, or natural disasters. It is also optional but recommended.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who is uninsured or underinsured. It is mandatory in NYC.

- Personal Injury Protection (PIP): This coverage pays for medical expenses and lost wages for you and your passengers, regardless of fault. It is mandatory in NYC.

Mandatory Car Insurance Requirements in NYC

New York State requires all drivers to carry a minimum amount of car insurance coverage. These requirements are:

- Liability Coverage: $25,000 per person for bodily injury, $50,000 per accident for bodily injury, and $10,000 per accident for property damage.

- Uninsured/Underinsured Motorist Coverage: $25,000 per person for bodily injury, $50,000 per accident for bodily injury, and $10,000 per accident for property damage.

- Personal Injury Protection (PIP): $50,000 per person.

Factors Affecting Car Insurance Costs

In New York City, where traffic is dense and accidents are common, car insurance costs can vary significantly. Understanding the factors that influence your premiums can help you make informed decisions to potentially save money.

Driving History

Your driving history is a major factor in determining your car insurance rates. Insurance companies use this information to assess your risk as a driver.

- Accidents: Having a history of accidents, even minor ones, will typically increase your premiums. The severity of the accident and whether you were at fault are considered.

- Traffic Violations: Speeding tickets, reckless driving, and DUI convictions can significantly impact your insurance costs. These violations indicate a higher risk of future accidents.

- Driving Record: A clean driving record with no accidents or violations will result in lower premiums.

Vehicle Type

The type of car you drive is another significant factor.

- Make and Model: Certain car models are known for their safety features and lower accident rates, which can result in lower insurance premiums. Luxury cars, sports cars, and vehicles with a high theft rate often have higher insurance costs.

- Safety Features: Cars with advanced safety features, such as anti-lock brakes, airbags, and stability control, are generally considered safer and can lead to lower premiums.

- Vehicle Value: The cost of repairing or replacing your car is factored into insurance premiums. More expensive cars typically have higher insurance costs.

Location

Where you live in NYC can impact your car insurance rates.

- Crime Rates: Areas with higher crime rates often have higher insurance premiums due to the increased risk of theft or vandalism.

- Traffic Congestion: Densely populated areas with heavy traffic are more prone to accidents, which can increase insurance costs.

- Weather Conditions: NYC’s unpredictable weather can increase the risk of accidents, particularly during snowstorms or heavy rain. This factor can be considered when setting premiums.

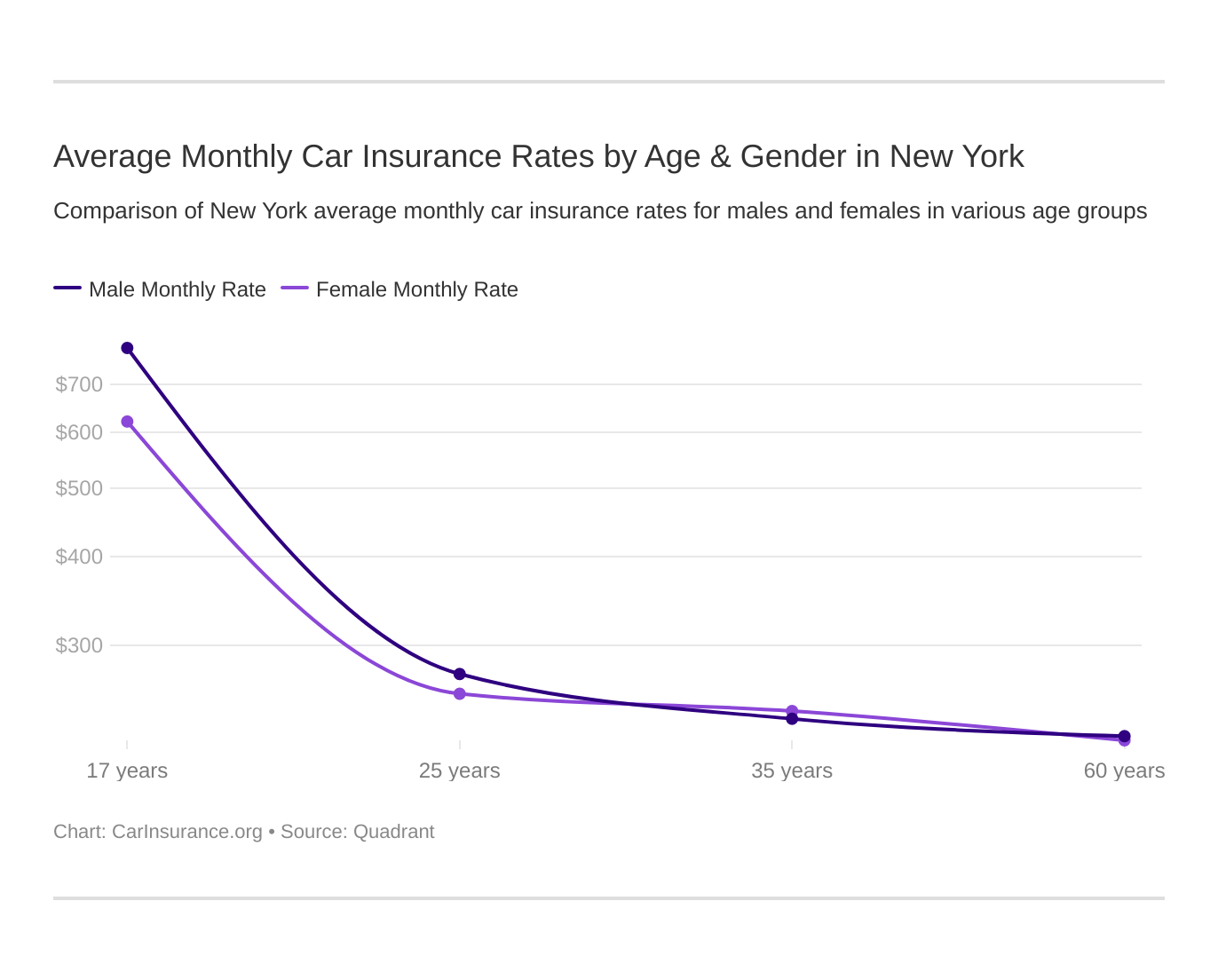

Age and Gender

While these factors are becoming less prominent in some states, age and gender can still influence insurance rates in NYC.

- Age: Younger drivers, particularly those under 25, often have higher insurance premiums. This is because they are statistically more likely to be involved in accidents due to lack of experience.

- Gender: Historically, men have had higher insurance premiums than women. This trend is attributed to men’s higher risk of accidents and driving violations.

Credit Score

In some states, including New York, your credit score can impact your car insurance rates.

- Credit History: Insurance companies use credit scores as a proxy for assessing your overall risk. Individuals with good credit history are considered more responsible and less likely to file claims, which can result in lower premiums.

- Credit Score Impact: A lower credit score can lead to higher insurance premiums. However, it’s important to note that credit score is not the only factor considered, and other factors like driving history and vehicle type also play a role.

Finding the Best Car Insurance Deals

Securing the most affordable car insurance in New York City can be a challenging task, considering the city’s high traffic density and potential for accidents. However, by strategically comparing quotes and negotiating with insurers, you can significantly reduce your premiums.

Comparing Car Insurance Quotes

To ensure you get the best deal, it’s essential to compare quotes from various insurance providers. This allows you to identify the most competitive rates and coverage options that align with your needs. Here’s a step-by-step guide to comparing quotes effectively:

- Gather Your Information: Before requesting quotes, assemble all the necessary details, including your driver’s license number, vehicle information (make, model, year), and driving history. This will streamline the quote process and ensure accuracy.

- Utilize Online Comparison Tools: Leverage online comparison websites such as Policygenius, The Zebra, or Insurance.com. These platforms allow you to input your information and receive quotes from multiple insurers simultaneously. This saves you time and effort compared to contacting each company individually.

- Contact Insurers Directly: While online tools are convenient, consider contacting insurers directly to discuss specific coverage options and potential discounts. This personalized approach allows you to ask questions and clarify details that may not be readily available on comparison websites.

- Compare Quotes Carefully: Once you receive quotes, carefully review the coverage details, deductibles, and premiums. Pay attention to factors like liability limits, comprehensive and collision coverage, and uninsured/underinsured motorist coverage. Ensure you understand the nuances of each quote before making a decision.

Negotiating Lower Insurance Premiums

While comparing quotes is crucial, negotiating with insurers can further reduce your premiums. Here are some tips and strategies for successful negotiations:

- Explore Discounts: Most insurers offer various discounts, such as good driver, safe driving, multi-car, and bundling discounts. Inquire about available discounts and ensure you’re taking advantage of all applicable ones.

- Consider Increasing Your Deductible: A higher deductible means you pay more out of pocket in case of an accident but can result in lower premiums. If you’re comfortable with a higher deductible, consider increasing it to potentially reduce your monthly costs.

- Shop Around Regularly: Don’t be afraid to switch insurers if you find a better deal. Regularly comparing quotes from different providers ensures you’re always getting the most competitive rates.

- Be Prepared to Walk Away: If you’re not satisfied with the insurer’s offer, don’t be afraid to walk away. The threat of losing a customer can sometimes motivate insurers to offer a more favorable rate.

Reputable Car Insurance Companies in NYC

Numerous reputable car insurance companies operate in New York City, each offering different coverage options and pricing structures. Here’s a list of some well-regarded providers:

- Geico: Known for its competitive rates and excellent customer service, Geico is a popular choice for car insurance in NYC.

- State Farm: A well-established and trusted insurer, State Farm offers a wide range of coverage options and discounts.

- Progressive: Progressive is known for its innovative features, including its “Name Your Price” tool, which allows you to set your desired premium and see which coverage options fit within your budget.

- Allstate: Allstate provides comprehensive coverage options and a strong focus on customer satisfaction.

- Liberty Mutual: Liberty Mutual is a reliable insurer offering a variety of discounts and coverage options.

Discounts and Savings: Car Insurance Prices Nyc

In the competitive landscape of car insurance in NYC, companies offer a variety of discounts to attract and retain customers. These discounts can significantly reduce your premiums, making car insurance more affordable. Understanding these discounts and their eligibility criteria is crucial for maximizing your savings.

Types of Discounts

Here’s a breakdown of common discounts offered by car insurance companies in NYC:

- Good Driver Discount: This discount is awarded to drivers with a clean driving record, free of accidents or traffic violations. This is one of the most common and significant discounts available.

- Safe Driver Discount: This discount is similar to the good driver discount, but it may consider factors like defensive driving courses or telematics programs that monitor your driving habits.

- Multi-Car Discount: If you insure multiple vehicles with the same company, you can qualify for a multi-car discount. This is a simple way to save on your premiums.

- Multi-Policy Discount: This discount applies if you bundle your car insurance with other insurance products like homeowners or renters insurance.

- Loyalty Discount: Some insurance companies reward long-term customers with loyalty discounts for staying with them for a certain period.

- Student Discount: Good grades or enrollment in college can qualify you for a student discount. This is often offered to students who are considered responsible drivers.

- Anti-theft Device Discount: Installing anti-theft devices like alarms or GPS tracking systems can make your car less attractive to thieves and qualify you for a discount.

- Vehicle Safety Feature Discount: Cars equipped with advanced safety features like airbags, anti-lock brakes, or lane departure warning systems are often eligible for discounts.

- Good Credit Discount: Some insurers consider your credit score when determining your premiums. A good credit score can lead to lower rates.

- Occupation Discount: Certain professions, like teachers or military personnel, may qualify for discounted rates.

Eligibility Criteria

To qualify for discounts, you need to meet specific criteria. These criteria vary depending on the insurer and the specific discount. Some common requirements include:

- Clean Driving Record: This usually involves no accidents or traffic violations within a certain period.

- Safe Driving Practices: Completing a defensive driving course or participating in a telematics program can demonstrate safe driving habits.

- Multiple Policies: You need to have multiple insurance policies with the same company to qualify for multi-policy discounts.

- Good Credit Score: This is often used for determining credit-based insurance scores, which can influence your premiums.

- Vehicle Features: Having certain safety features or anti-theft devices installed in your vehicle can qualify you for discounts.

Maximizing Savings

Here are some tips to maximize your savings through discounts:

- Compare Quotes: Contact multiple insurers to compare quotes and see which offers the most discounts for your situation.

- Ask About Discounts: When you contact insurers, be sure to ask about all the discounts they offer and their eligibility criteria.

- Maintain a Clean Driving Record: This is the most crucial factor for obtaining discounts. Avoid accidents and traffic violations.

- Consider Bundling Policies: Bundling your car insurance with other insurance products can lead to significant savings.

- Install Safety Features: Installing anti-theft devices or vehicles with advanced safety features can qualify you for discounts.

- Improve Your Credit Score: A good credit score can lead to lower insurance premiums.

Common Car Insurance Claims in NYC

New York City, known for its bustling streets and dense traffic, sees its fair share of car accidents. Understanding the most common car insurance claims in NYC can help you be prepared and navigate the claims process smoothly.

Types of Car Insurance Claims, Car insurance prices nyc

Here are some of the most frequent car insurance claims filed in NYC:

- Collision Claims: These claims occur when your vehicle collides with another vehicle, object, or even a pedestrian.

- Comprehensive Claims: These claims cover damage to your vehicle caused by events other than collisions, such as theft, vandalism, fire, hail, or natural disasters.

- Liability Claims: These claims arise when you are found at fault for causing an accident that results in injuries or property damage to another party.

- Uninsured/Underinsured Motorist Claims: These claims come into play when you are involved in an accident with a driver who does not have insurance or has insufficient coverage.

- Personal Injury Protection (PIP) Claims: These claims cover medical expenses and lost wages for you and your passengers, regardless of who is at fault in an accident.

Filing a Car Insurance Claim in NYC

Here’s a general overview of the claim filing process:

- Report the Accident: Contact your insurance company immediately after the accident to report the incident. This is crucial for initiating the claim process.

- Gather Information: Collect all relevant details from the accident, including the names and contact information of all parties involved, the police report number (if applicable), and photos of the damage.

- File a Claim: Your insurance company will provide you with a claim form, which you need to complete and submit along with the gathered information.

- Provide Documentation: Be prepared to provide your insurance company with supporting documentation, such as medical bills, repair estimates, and police reports.

- Claim Review and Settlement: Your insurance company will review your claim and determine the extent of coverage. They may send an adjuster to inspect the damage and assess the claim.

Tips for a Smooth Claim Process

- Be Prompt: Contact your insurance company as soon as possible after the accident. The sooner you file a claim, the faster the process can move.

- Be Accurate: Provide accurate and complete information to your insurance company. This will help prevent delays and ensure a smooth claim process.

- Be Cooperative: Be cooperative with your insurance company and the adjuster throughout the process. This includes providing all necessary documentation and answering their questions truthfully.

- Keep Records: Maintain a record of all communications with your insurance company, including dates, times, and the content of conversations. This will help you track the progress of your claim.

- Seek Legal Advice: If you feel that your claim is not being handled fairly, or if you have questions about your rights, consult with a lawyer specializing in insurance claims.

Driving Safely in NYC

Driving in New York City presents unique challenges due to its dense population, heavy traffic, and complex road network. Navigating this urban jungle requires vigilance, awareness, and a proactive approach to safety.

Common Driving Hazards and Risks in NYC

New York City’s driving environment poses numerous hazards. These include:

- Heavy Traffic: Congestion is a constant factor in NYC, leading to aggressive driving, tailgating, and sudden stops.

- Pedestrians and Cyclists: The city’s high pedestrian and cyclist density increases the risk of collisions, especially in crosswalks and intersections.

- Aggressive Drivers: NYC drivers are known for their impatience and aggressive driving styles, leading to road rage and unsafe maneuvers.

- Road Construction: Constant road repairs and construction create unpredictable traffic patterns, lane closures, and potential hazards.

- Weather Conditions: Snow, ice, and heavy rain can significantly impact road conditions, increasing the risk of accidents.

- Parking Challenges: Finding and maneuvering in tight parking spaces can lead to collisions with other vehicles or obstacles.

- Distracted Drivers: The city’s fast-paced environment can lead to distractions like cell phone use, eating, and other activities that compromise driving focus.

Tips and Strategies for Safe Driving in NYC

To navigate the city’s roads safely, consider these tips:

- Defensive Driving: Always anticipate potential hazards, maintain a safe following distance, and be prepared to react quickly to sudden changes in traffic conditions.

- Stay Alert: Avoid distractions like cell phones, eating, or adjusting the radio. Focus on the road and be aware of your surroundings.

- Be Patient: Avoid aggressive driving, tailgating, or cutting off other vehicles. Patience is crucial in managing traffic stress.

- Know the Rules: Familiarize yourself with NYC’s traffic laws, especially those related to pedestrian and cyclist safety.

- Use Turn Signals: Always signal your intentions clearly to prevent confusion and potential collisions.

- Avoid Distracted Driving: Put away your phone and refrain from using electronic devices while driving.

- Maintain Vehicle Condition: Regularly check your tires, brakes, lights, and windshield wipers to ensure your vehicle is safe to operate.

- Be Aware of Blind Spots: Check your mirrors frequently and use your blind spot mirrors before changing lanes.

- Yield to Pedestrians: Always yield to pedestrians, especially in crosswalks.

- Be Prepared for Sudden Stops: Maintain a safe following distance to avoid rear-end collisions.

- Plan Your Route: Use navigation apps to plan your route and avoid known traffic congestion areas.

- Drive Defensively: Be prepared for unexpected situations and react accordingly.

Defensive Driving Techniques in NYC

Defensive driving techniques are essential for safe driving in NYC. They involve anticipating potential hazards and reacting proactively to prevent accidents.

“Defensive driving is not about being defensive, but about being prepared.”

- Scanning the Road: Constantly scan the road ahead, looking for potential hazards like pedestrians, cyclists, parked cars, and other vehicles.

- Maintaining a Safe Following Distance: Leave enough space between your vehicle and the car in front of you to allow for safe braking and maneuvering.

- Anticipating Potential Hazards: Be prepared for sudden stops, lane changes, and other unpredictable driving behaviors.

- Staying Aware of Surroundings: Be mindful of your surroundings, including pedestrians, cyclists, and other vehicles, even when stopped at intersections.

- Avoiding Distractions: Minimize distractions by putting away your phone, refraining from eating while driving, and focusing on the road.

Car Insurance Coverage Options

Navigating the world of car insurance in NYC can feel overwhelming, especially when faced with a variety of coverage options. Understanding the benefits and limitations of each type of coverage is crucial for making informed decisions about your car insurance policy. This section delves into the most common coverage options, providing guidance on choosing the right coverage for your individual needs and driving habits.

Liability Coverage

Liability coverage is the most basic type of car insurance and is required by law in New York State. It protects you financially if you cause an accident that results in injuries or damage to another person’s property.

Liability coverage has two components:

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages incurred by the other driver or passengers in the event of an accident caused by you.

- Property Damage Liability: This coverage pays for repairs or replacement of the other driver’s vehicle or property damaged in an accident caused by you.

The limits of liability coverage are expressed as a series of numbers, such as 25/50/10, which represent:

$25,000 per person for bodily injury liability

$50,000 per accident for bodily injury liability

$10,000 per accident for property damage liability

The minimum liability coverage required in New York State is 25/50/10. However, it is highly recommended to have higher limits to protect yourself financially in the event of a serious accident.

Collision Coverage

Collision coverage pays for repairs or replacement of your own vehicle if it is damaged in an accident, regardless of who is at fault.

It is crucial to note that collision coverage does not cover damages caused by events like vandalism, theft, or natural disasters.

- Example: If you are involved in an accident and your vehicle is damaged, collision coverage will pay for the repairs, even if you were at fault. However, if your car is damaged by a falling tree, collision coverage will not apply.

Comprehensive Coverage

Comprehensive coverage protects you from damages to your vehicle caused by events other than collisions, such as theft, vandalism, fire, natural disasters, and animal collisions.

- Example: If your car is stolen or damaged by a hailstorm, comprehensive coverage will pay for repairs or replacement. However, if your car is damaged in an accident with another vehicle, comprehensive coverage will not apply.

Wrap-Up

By understanding the key factors that influence car insurance prices in NYC, drivers can make informed decisions about their coverage, explore various discounts, and ultimately find the best deals that fit their individual needs and budgets. Armed with the knowledge and resources Artikeld in this guide, you can confidently navigate the complexities of car insurance in the city that never sleeps.

Car insurance prices in NYC can vary greatly depending on factors like your driving record and the type of car you own. If you’re considering moving to a different state, it’s worth researching the cost of car insurance in your new location.

For example, car insurance in South Dakota might be more affordable due to lower population density and less traffic. However, keep in mind that car insurance prices in NYC are heavily influenced by the high volume of vehicles and the city’s unique driving conditions.

Post a Comment